John Waggoner and Andy Markowitz,

Published August 13, 2020 / Updated August 12, 2024

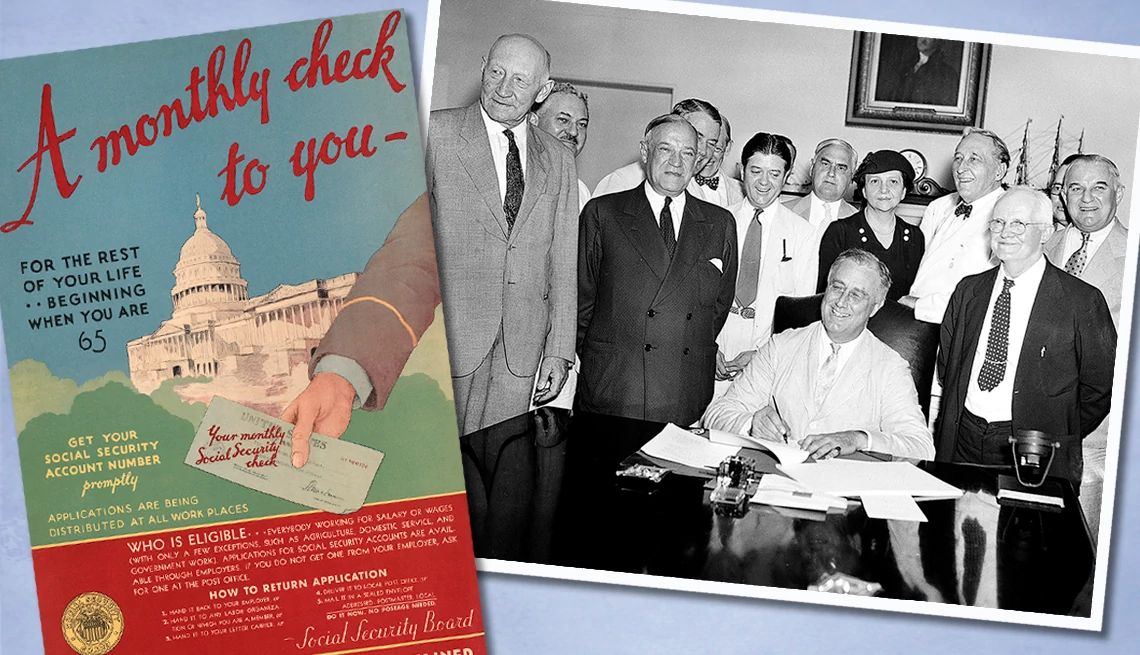

Social Security was born 89 years ago this Wednesday, in 1935, and over the subsequent decades it has matured into a vital source of inflation-adjusted income for retirees, people with disabilities, and their dependents and survivors. As of June 2024, the program was paying monthly benefits to more than 72 million Americans. Here’s a time line of significant events in the history of Social Security.

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Aug. 14, 1935: President Franklin Delano Roosevelt signed the Social Security Act into law.

Jan. 1, 1937: First Social Security benefits paid out in the form of one-time, lump-sum payments.

Left: A stack of Social Security applications. Right: Ida M. Fuller was first Social Security monthly beneficiary.

AARP (Source: AP Newsroom (2), background: Getty Images))Aug. 10, 1939: Program broadened to include benefits for workers’ dependents and survivors.

Jan. 31, 1940: Ida M. Fuller became the first person to receive a monthly benefit. Her first check was for $22.54, the inflation-adjusted equivalent of $509.46 today. Fuller lived to the age of 100.

October 1950: Congress authorized the first cost-of-living adjustment (COLA), an increase of 77 percent.

Aug. 1, 1956: Social Security Act amended to provide benefits to workers with disabilities ages 50 to 64 and adults with disabilities dating to childhood, and to allow women to take early retirement at age 62, albeit at a reduced Social Security benefit. Previously, no one could claim retirement benefits until age 65.

September 1960: President Dwight Eisenhower signed a law amending the disability rules to permit payment of benefits to workers with disabilities of any age and to their dependents.

June 30, 1961: Social Security Act amended to reduce the minimum eligibility age for retirement benefits to 62 for all workers, regardless of gender.

Oct. 30, 1972: Congress established Supplemental Security Income (SSI), a national benefit program administered by Social Security that provides monthly cash payments to people who are 65 or older, blind, or have a disability and have very low incomes and limited assets.

July 1975: The first annual automatic COLA kicked in, boosting benefits by 8 percent. Before 1975, congressional authorization was required to adjust benefits for inflation.

July 1980: Beneficiaries received the highest annual COLA increase ever — 14.3 percent. The inflation rate in 1980 was 12.5 percent.

ARTICLE CONTINUES AFTER ADVERTISEMENT

April 20, 1983: President Ronald Reagan signed into law sweeping changes to Social Security, based on recommendations of the National Commission on Social Security Reform (also known as the Greenspan Commission) aimed at shoring up the program’s shaky financial footing. These included increasing the payroll taxes that fund Social Security; gradually raising the full retirement age (FRA) from 65 to 67; and making 50 percent of Social Security benefit income taxable for recipients with overall incomes above $25,000 for an individual and $32,000 for a married couple filing jointly.

Oct. 1, 1988: A nationwide toll-free number was implemented for people to contact the Social Security Administration (SSA).

Aug. 10, 1993: President Bill Clinton signed the Omnibus Budget Reconciliation Act, a massive package of tax increases and spending cuts that included a provision raising the share of Social Security benefits subject to income tax from 50 percent to 85 percent for beneficiaries with incomes above $34,000 (single) or $44,000 (couple).